“It is over. The trading that existed down the centuries has died.

We have an electronic market today. It is the present. It is the future.”

Robert Greifeld, NASDAQ CEO, April 2011

PRE-HISTORY OF FINANCIAL TRADING

Many people believe that financial trading is something modern. However, the principles of financial contracts were known even in Ancient Greece.

Thales of Miletus, a famous scientist who lived in 600 BC, based on the astronomy, predicted the weather and good harvest for the next year. Then he made a contract with the olive presses owners. According the contract, Thales paid the certain amount of money in advance and received an exclusive right of using the presses. Later he sold his right to farmers by higher price. Aristotle wrote down this story and this is the first known example of creating and using a contract we nowadays call option contract.

First modern futures contract was sold on Chicago Board of Trade (CBOT) in the middle of 19th century. That helped American farmers to avoid risks with commodity prices and helped the agricultural sector to grow. For example, a farmer can buy a futures contract at the beginning of a year and sell his commodity and a contract after the harvest gathering. In case of a good harvest he will benefit from his actual product, in other case he will benefit from a futures contract. Using this principle named hedging, farmers can optimize their risks and be more flexible making strategy decisions.

A wide usage of computers and Internet at the very end of 20th century made it possible to develop software for financial market, in particular, trading platforms. Previously you had to call your broker telling him what you want to buy or sell, then the broker had to enter the pit, execute your request and report you by phone. Using a trading platform, you can do absolutely the same in one mouse click.

WHO IS WHO ON THE FINANCIAL MARKET?

The financial trading based on the cooperation of traders, brokers and the exchange.

Traders are buying and selling contracts between themselves. Traders are not making money out of nothing: each time the trader gets profit, his/her counter-agent gets loss. According to statistics, 92% of traders get loss at the end of their first year on financial markets.

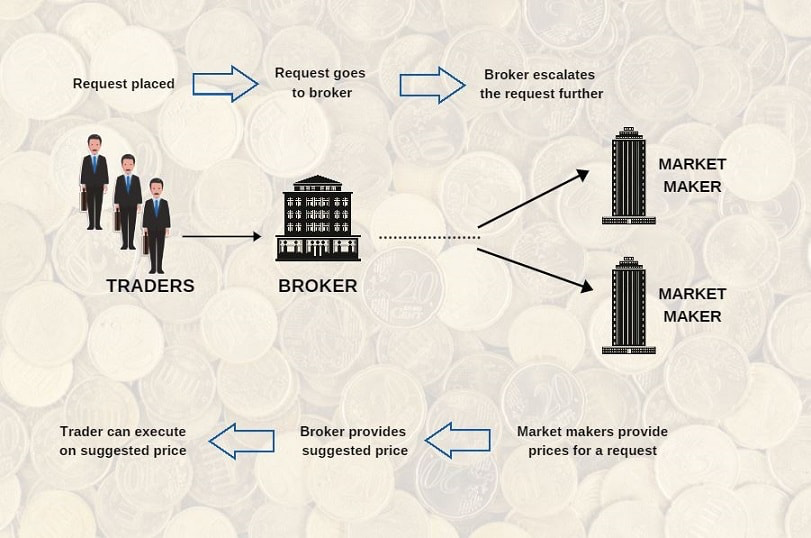

Brokers provide access to the exchange (or another broker) to the traders. They make their money from different types of commissions. Brokers usually compete among themselves trying to attract customers to trade with the certain broker offering lower commissions or better conditions. Term “broker” can be used for small company and for big tier one market maker bank, therefore it is very popular to distinguish brokers based on their role and operations.

Exchange is a regulator on financial market. Exchange guarantee that each player on the market follows rules and fulfills their commitments. It also has ability to rollback certain trades. There was an issue around 10 years ago, when trading robots by mistake started offering some contracts for 0.01$ (or some similar price). During that trading day many people became millionaires while many other became bankrupts. On the next day the exchange made a decision to rollback all the deals, where one of the parties got profit more than 300%. It helped to revert trades made with abusing mistake done by robots and keep the deals made correctly. This example illustrates how exchange may act on the market.

How brokers proceed trade requests?

WHAT BUSINESS FIELDS/FUNCTIONALITIES USUALLY TRADING PLATFORMS COVER?

Trading platform is a complex of software products primarily used to trade financial assets. It is possible to define several types of usage based on the client type:

Brokers offer a trading application for their customers (retail traders). Some brokers develop their own platforms using internal IT department, others are willing to buy some already developed platform from third-party IT companies.

Banks might have their trading departments which works similar to brokers. Also, banks usually use trading platforms for internal departments working with investments, money management, risk management, insurances etc.

Exchanges might use a trading platform like brokers do. It makes sense for small local exchanges, which are not big enough to attract many brokers to work with them, for instance, local agricultural exchange of some country.

Hedge funds typically use trading platform for the internal teams of traders.

In the following aticle you will find information about such important aspects like latency, algorithmic trading and HFT (high frequency trading). Also I will share several interesting examples from my development experience.